- American Economy Daily

- Posts

- Remarkable Reversal and Rise in 2023.

Remarkable Reversal and Rise in 2023.

Another Bull in 2024?

Quick Update: Exciting news for 2024! We're introducing engagement rewards to express our appreciation for your active participation. Stay tuned for the chance to win $100 Amazon gift cards, exclusively for our most engaged members!

Auto Insurance: Overpriced!

Just because you have to renew your auto insurance every 6 months does not mean you have to overpay!

The sad truth: 50% of U.S. drivers overpay for their auto insurance.

There are 3 SIMPLE steps to solve the problem:

Step 1) Visit our page on this

Step 2) Enter your Zip Code, fill out a 1-page form

You will really enjoy the benefits of this simple process; you no longer have to be in the 50% that overpays!

Help us keep going! Support our sponsors – they're the key to our publication's future.

2023 Stock Market Revisited

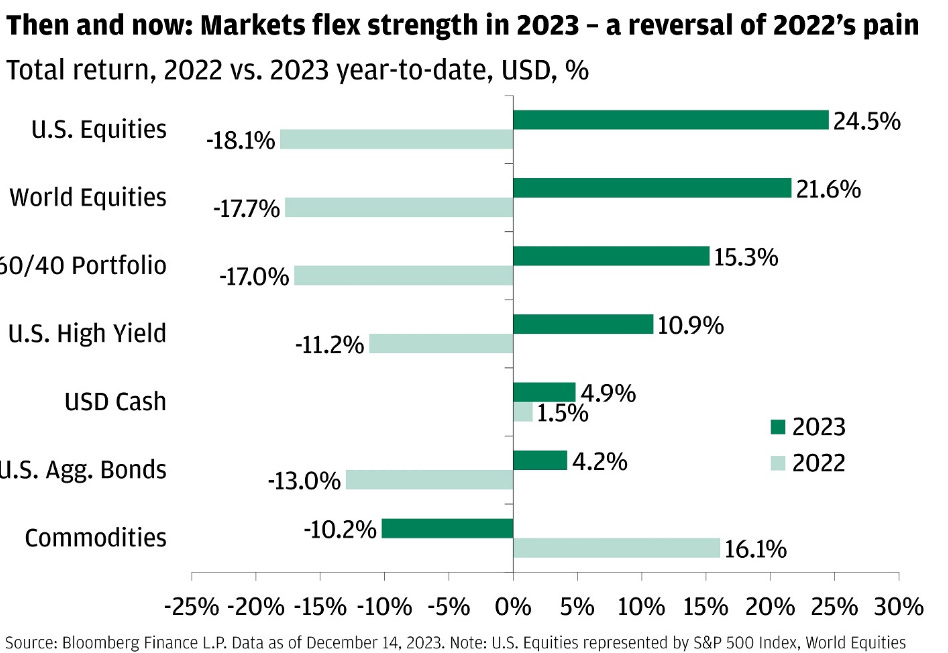

In 2023, the S&P 500 witnessed a significant upsurge of 23%, marking a stark turnaround from the previous year. This shift transformed many markets from a state of weakness to one of strength. Contrasting with the late 2022 speculations about an impending major recession, the year 2023 is concluding on a high note, fostering optimistic projections for a stronger 2024.

In the past three years, the S&P 500 has exhibited a rollercoaster of performance, with a decline of 18% in 2022, a surge of 27% in 2021, and a solid gain of 16% in 2020.

Consolidated Gains

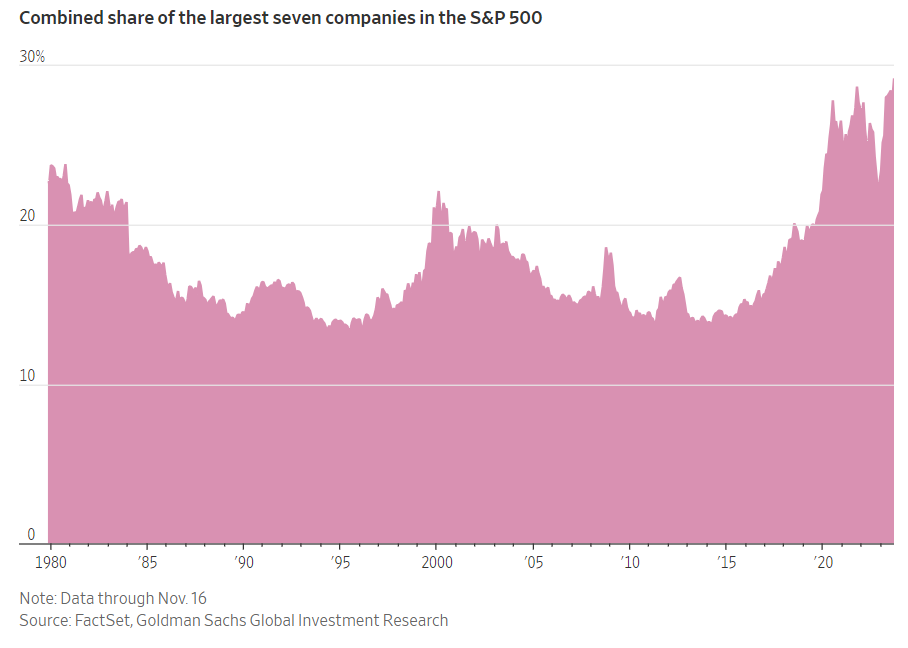

The Magnificent Seven stocks have swelled to represent about 30% of the S&P 500’s market value, according to Goldman Sachs Global Investment Research. That is approaching the highest-ever share for any seven stocks. The "Magnificent Seven" stocks include Apple, Amazon, Alphabet, Meta Platforms, Nvidia, Microsoft, and Tesla.

The "Magnificent Seven" are collectively up nearly 75% for the year and have largely driven the S&P 500's 22% gain.

Despite the overall market's rise this year, the dominance of seven key stocks raises concerns about potential market instability in 2024, since any significant fluctuation in these companies could disproportionately impact the market as a whole.

More Players In The Game

In 2023, the US stock market experienced a significant shift in household participation, with the Federal Reserve's survey of consumer finances revealing that 57% of US households owned stocks. This figure marks the highest household stock-ownership rate recorded in the triennial survey, up from 53% in 2019.

The increase in stock ownership was facilitated by several factors. During the pandemic, many Americans found themselves with extra cash and time, leading to millions jumping into the stock market for the first time. Brokerages also played a crucial role by making investing cheaper and more accessible than ever. Direct stock ownership increased to 21% of families in 2022 from 15% in 2019, marking the largest increase on record since the survey began in 1989.

Alternative Money Flows

With rates being raised 11 times since March 2022, alternative investments had major changes. 1 year Certificates of Deposit (CDs) rose to rates over 5% and money market funds have seen significant inflows of cash, with their total value increasing from $1.5 trillion in March 2022 to $3.89 trillion. Three and six-month Treasuries have offered yields above 5% for most of 2023.

2023 Stock Market Volatility Drops

In 2023, the US stock market experienced a massive drop in Volatility. Despite the aggressive interest-rate hikes in 2023, the erosion of corporate profits, and the failure of regional banks, betting against equity price swings proved to be a successful strategy. The CBOE Volatility Index VIX tumbled to near four-year lows, even in the face of these challenges. Short-volatility strategies typically involve selling a put on a stock or index while investing in a risk-free asset like Treasuries. These strategies tend to thrive in bullish market conditions, such as the 23% advance in the S&P 500 in 2023. However, they can backfire during rapid sell-offs that ignite volatility.

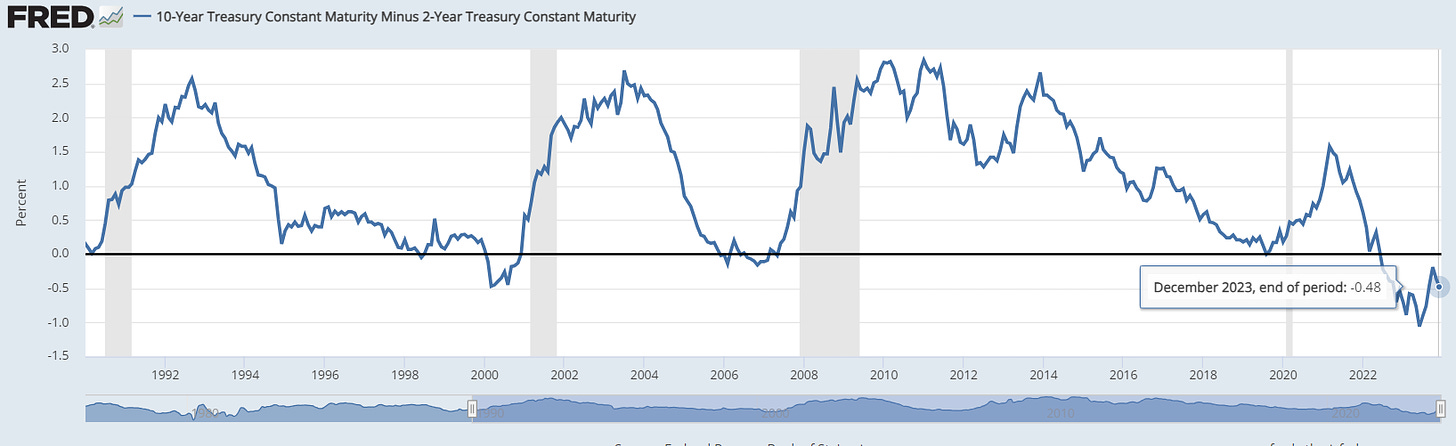

Yield Curve Inversion

The market in 2022-2023 has had to grapple with the risk of a potential recession. The inverted Treasury yield, which has been seen as a warning sign for an economic slump for almost two years, was a cause for concern. The yield curve inverts when short-term interest rates exceed long-term rates, which can signal a lack of confidence in the near-term economy. In 2023, the gap between shorter-term yields and longer-term yields widened substantially. Speculation that rates would stay higher for longer briefly pushed the 10-year Treasury yield to 5% in October, almost closing the gap completely with the two-year note. However, by the end of the year, the yield had fallen back below 4%.

2024 Market Expectations

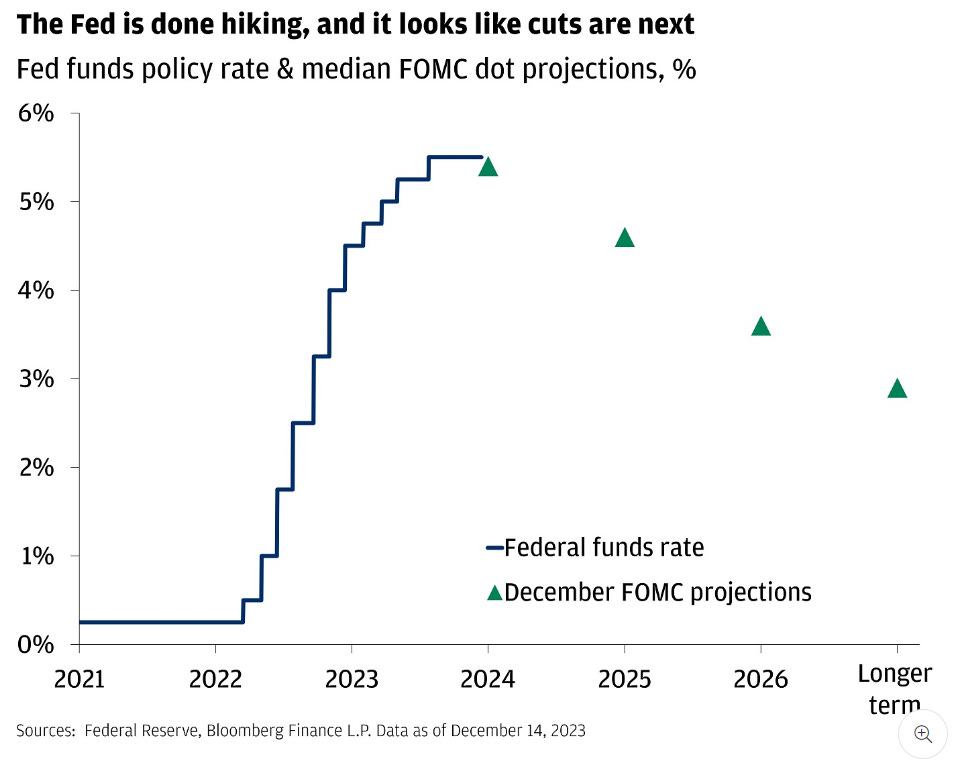

As we approach the end of 2023, investors are looking forward to 2024 with optimism. While the S&P 500 isn't cheap at 19 times next year's expected earnings, stocks look poised for another strong year. Investors are anticipating a soft economic landing due to the Federal Reserve's actions.

However, they also expect the Fed to cut rates significantly over the course of the year. The Federal Reserve's dot plot forecasts three interest-rate cuts in 2024, and the market expects even more. This dual expectation of a soft landing and multiple rate cuts suggests a reckoning may be on the horizon, as these two outcomes are unlikely to coexist.

Lower interest rates in theory should help consumers and businesses alike. Mortgage rates fell below 7% this past week for the first time since August, which could get potential home buyers off the sidelines. Businesses will also enjoy lower borrowing costs, greasing the wheels for more deal making and hiring. However, it's important to consider the reasons why rates could be heading lower.

The Fed doesn't cut interest rates to be magnanimous; they cut interest rates because they see weakness in the economy or rising financial risks. This could lead to a credit-tightening recession, something that seems likely, given that traders are pricing in as many as six rate cuts in the next year.

In the past 30 years, when the Federal Reserve has cut rates, it has often done so swiftly, leading to a sharp pullback in 3-month T-bill rates. Such sudden cuts could potentially erase 5% yields on T-bills, money-market funds, and other cash-like investments almost instantaneously. Despite the potential for falling rates, bonds remain an attractive investment option. Longer-duration bonds purchased now could offer investors the chance to lock in a higher yield and the possibility of price appreciation if interest rates fall. Indeed, the case for a classic 60/40 portfolio split of stocks and bonds is getting stronger in 2024.