- American Economy Daily

- Posts

- Banks Profiting Before the BTFP Shutdown

Banks Profiting Before the BTFP Shutdown

But why is BTFP still rising?

eBook: How to minimize third-party risk with vendor management

A robust vendor management program isn’t just required by compliance frameworks like SOC 2 and ISO 27001. It’s also a critical part of a holistic trust management strategy.

Implementing a vendor management program, however, has become more complex and challenging with the proliferation of SaaS tools and shadow IT. And many overstretched security teams are being asked to do more with less.

To stay compliant and secure — and deepen trust with customers and partners — security teams need a way to proactively manage vendor risk.

This guide from Vanta, the leading trust management platform, brings together perspectives from the frontlines of vendor security management. Get insights and best practices from security and compliance leaders.

Help us keep going! Support our sponsors – they're the key to our publication's future. One click is all you have to do.

The Bank Term Funding Program (BTFP)

The BTFP was created as a direct response to the banking crisis that unfolded after the significant withdrawal of deposits from Silicon Valley Bank (SVB) in March 2023. This program has gained renewed attention recently, largely because of the central bank's shift towards a more dovish stance — meaning they are leaning towards more supportive monetary policies — and the growing expectations of interest rate cuts.

Just a refresher, the BTFP allows banks to borrow against eligible collateral like US Treasuries, agency debt, mortgage-backed securities, and other qualifying assets, offering loans up to one year in duration. This enables banks to borrow against the face value of their assets, providing liquidity against high-quality securities and avoiding the need to quickly sell securities during stressful periods. This facility is described as a "backstop" for the banking sector, aimed at quelling depositor concerns and providing banks with a tool for generating liquidity.

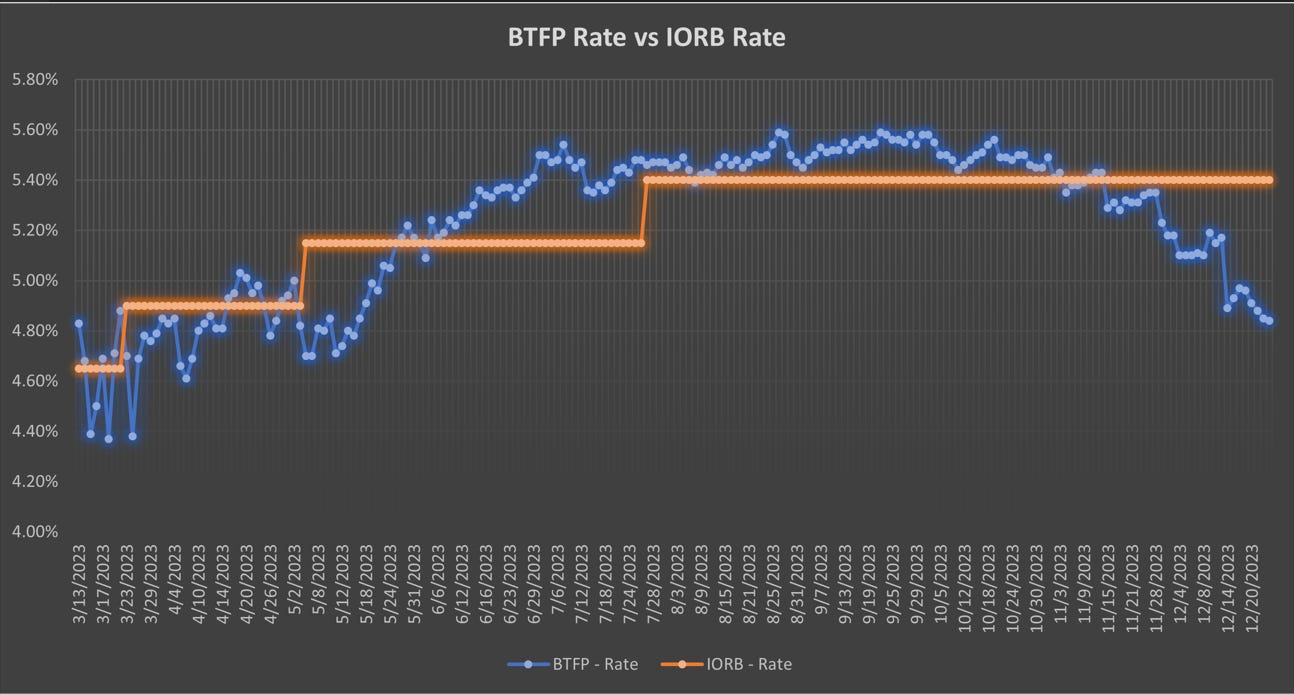

The facility’s appeal has recently increased as the Fed's swaps pricing indicated about 140 basis points of rate cuts by December 2024. In contrast to September, when the BTFP rate was around 5.61%, it now stands at a more favorable ~4.9%. This rate is lower than the Fed's IORB rate, which is at 5.4% Banks can leverage an arbitrage opportunity by borrowing at the BTFP rate (~4.9%) and then depositing these funds in their Fed accounts (IORB) to earn interest on reserve balances, currently at 5.40%

BTFP Termination

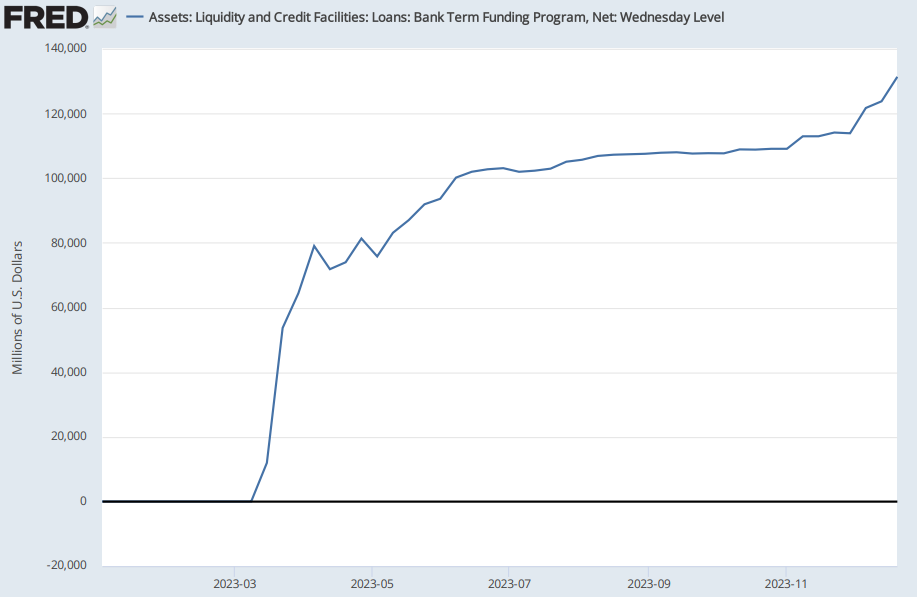

The authorization for the BTFP ends on March 11, 2024, giving banks until that date to pledge collateral and potentially recapitalize their holdings into 2025. The use of the BTFP has increased throughout 2023, with borrowing from the facility reaching $124 billion by December 13. With recent forecasts from the Federal Reserve projecting greater stability in 2024 and several interest rate cuts, this could spell the end for the BTFP. This rosier outlook makes it less likely that the BTFP will be renewed next March.

The Federal Reserve’s Influence

The Federal Reserve's decision to increase interest rates to counter inflation had a significant impact on the bond market. The rapid rise in interest rates resulted in a decline in bond prices, leaving many banks undercapitalized. In 2023 five banks have failed. These include Silicon Valley Bank, Signature Bank, First Republic Bank, Heartland Tri-State Bank, and Citizens Bank. Despite a bond market rally and increased bond values, banks continue to draw from the bailout program, indicating their could be underlying issues in the banking system.

BTFP Continual Rise

The BTFP was introduced as a solution to a potential banking system collapse. In March 2023, when Silicon Valley Bank Signature first went public and subsequently went bust, the BTFP spiked to about 65 billion dollars. However, it did not return to zero; instead, it continued to rise, reaching over 100 billion dollars. More recently, since October, it has risen from around 105-108 billion to a staggering 123 billion dollars.

This surge in the BTFP is significant when considered alongside the behavior of the 10-year treasury yield. In early October, the 10-year treasury was around 5%. However, it has since crashed to under 4%, a significant move that signals a potential hard landing in 2024. The mechanics behind the BTFP are crucial to understanding why this is significant. Banks had been holding treasuries on their balance sheets that were losing value due to rising rates. The BTFP was set up to allow banks to sell these treasuries at their original purchase price, despite their decreased market value. This was intended to prevent a liquidity crisis caused by banks being unable to sell these assets due to increased perceived risk in the banking system.

However, as the yield on the 10-year treasury decreases, the price of these treasuries increases. This means that banks holding these treasuries are now making money due to price appreciation. Despite this, the BTFP continues to rise, suggesting that the perceived risk in the banking system is increasing at an alarming rate. In fact, the current yield on the 10-year treasury is lower than it was in March 2023, when the banking crisis first began. Yet, the BTFP is still rising, indicating that the perceived risk in the banking system is potentially greater now than it was at the start of the crisis.

Is the BTFP just a playback of the repo market from 2019?

In September 2019, the overnight loan rate spiked from an average of about 2% to 10%, indicating that one or more financial firms were in trouble. This led to the Fed making billions of dollars in emergency repo loans available daily to 24 trading houses on Wall Street, most of which were owned by mega banks. However, the specific banks and the amounts they borrowed were not disclosed, making it impossible for the public to identify which firms were experiencing a severe liquidity crisis.

This was the first time the Fed had intervened in the repo market since the 2008 financial crash, another crisis that federal banking regulators failed to foresee. The emergency repo loan program lasted from September 17, 2019, until July 2, 2020.

In response to the spring banking crisis of 2023, which saw the rapid failure of First Republic Bank, Silicon Valley Bank, and Signature Bank, the Federal Reserve introduced a new bailout program known as the Bank Term Funding Program (BTFP). This program provides loans for up to one year. This is quite similar to the duration of the emergency repo loan program as well.

So a rundown between the two. A banking crisis occurs and then an emergency facility that lasts for one year is setup to inject liquidity into the financial system to prevent a market crash. In 2020 we have a market crash anyway but this crash is attributed to covid. It seems highly likely that the 2019 crisis played a major role in the market as well and yet it is never mentioned when talking about the covid crash. We shall see if this same playbook plays out in 2024.